Clearing up some Misinformation about TIF, or Tax Incremental Financing.

Ald. Nancy Moore, The Mayor and others seem to have a very weird understanding of how TIF works. In this included post, she claims that TIF has no impact on your taxes. She claims it is simply paid by the developers. Never mind that you freeze the value of the property to use the increment to pay back the loan, meaning the rest of the city shoulders a larger proportion of the property tax burden while the newly developed property is assessed at its predevelopment value. You only receive the full benefit of development when the TID closes and the property is then taxes at its full assessment. Either she is purposely glossing it over to minimize how it looks, or she just really doesn’t know. Experience matters. When I was on the City of Madison Housing Committee, and the Chair or the Affordable Housing Trust Fund, we worked with TIF a lot. We talked about TIF a lot. TIF is often one of the only tools available to small cities to try and spur affordable housing. We absolutely don’t utilize it that way. Look at the Current. Not only did the city pay $1 million to compensate the yacht club, they then gave the property to the Current, and offered Tax Incremental Financing on top if it. Right now, and there really is no way around it, your taxes are subsidizing that property until the TIF district matures and closes. That’s the truth with no spin at all. I’m including the original post.

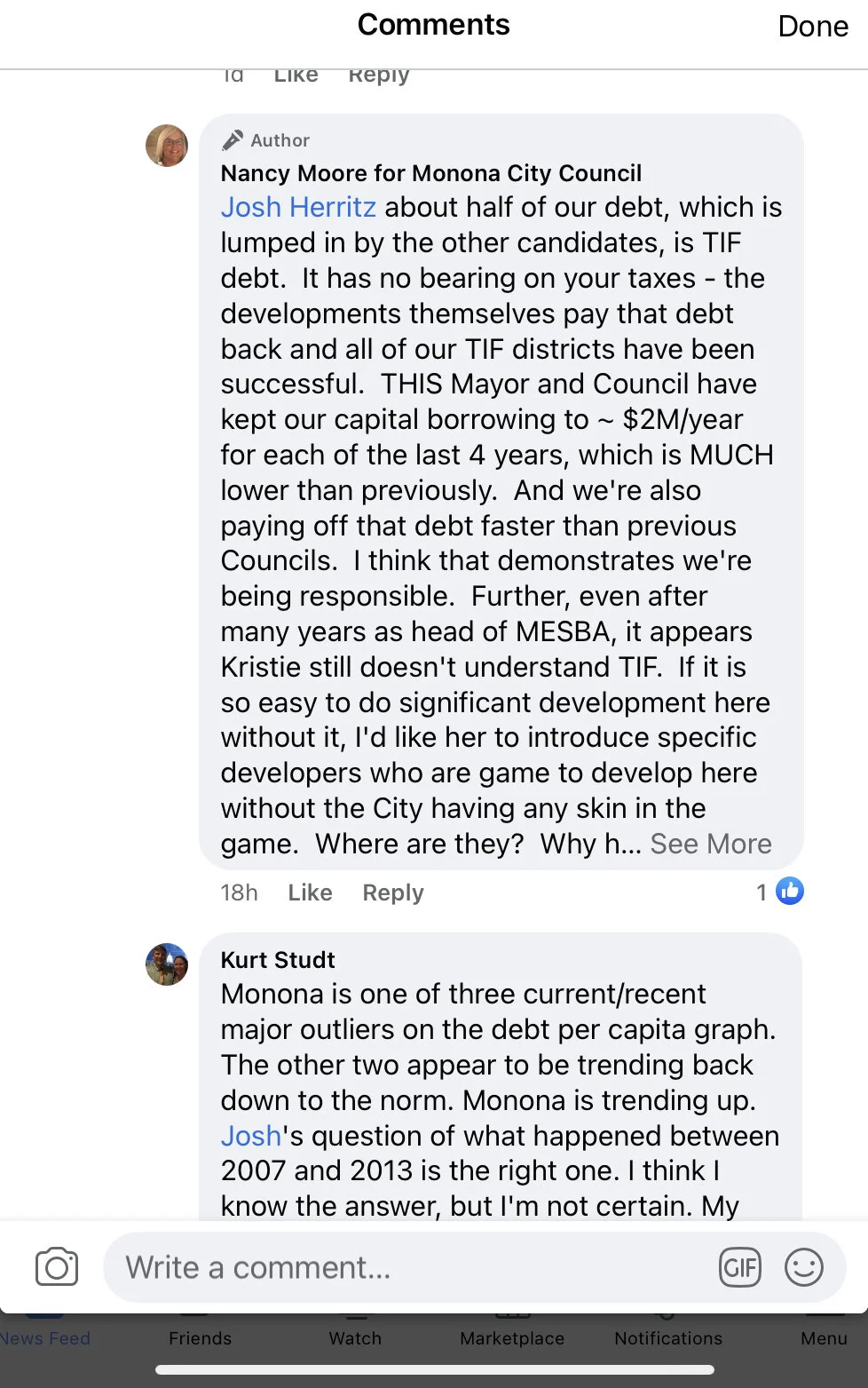

Original explanation by Alder Moore about TIF debts and claims that they don’t impact your property taxes.